Articles

The Long Shot

06.04.2019

You’ve likely heard of the 1%; let me introduce you to the 2%.

When I started kicking footballs in my backyard at age 9, I had no idea how much sports would shape so much of who I am. From my first extra point in an actual game to the moment I knew it was time to move on, football taught me more life lessons than I would have learned without it. However, it was during my time as a collegiate athlete that I learned the most formidable lessons about accountability, effective time-management and the importance of self-awareness. That experience was as unique as it was invaluable because according to the NCAA, I was a part of the 2% of high school athletes that receive athletic scholarships (a statistic that includes both “full rides” and partial scholarships). Yet, a 2019 survey of 1000 parents conducted by TD Ameritrade said that 50% of parents felt confident their child would get an athletic scholarship and as a result, they were willing to sacrifice they’re financial well-being to make it happen…that means at least 49% of parents are going to be very disappointed after spending in some instances, tens of thousands of dollars annually to improve their children’s chances to have a higher education paid for as a result of athletic prowess. Though that pails in comparison to the $25 million paid by 33 parents like aunt Becky to a scam charity to get their children into college, it’s still a significant investment with no guarantee of getting ones money back via athletic scholarship . But with the rising cost of a college education created be government subsidies and the demand for higher education in the work place, a lot of parents may think they have no choice, especially if there are no college savings already in place and unfortunately, youth sports are not getting cheaper. Even though participation in youth sports is declining, the cost for participation is rising quickly due to the recent explosion of “elite” teams and the travel that comes with participation. For example, a study according to Wintergreen Research estimates that annual costs for hockey could easily exceed $25,000 when special coaching, camps, registration, venues, travel and equipment are included. Granted, hockey statistically speaking, provides the highest likelihood of a kid receiving a scholarship because it’s played by so many less students than say basketball which boasts 64 high school athletes for every 1 college scholarship. So to a large degree, the sport determines the costs. It’s estimated that parents spend over $4,000 per child in baseball and over $8,000 per child on volleyball.

My son is only 7 but after finishing his 3rd season of baseball, I can see how quickly youth sports can get out of hand, not just financially, but also in terms of a child’s physical well-being. For example, a study presented during the American Orthopaedic Society for Sports Medicine’s 2015 annual meeting noted that 15-to-19-year-old males made up 56.7 percent of all Tommy John surgeries performed in the United States between 2007-11, a rate that was going up 9.1 percent per year. When these statistics are considered alongside the financial pressures parents put on themselves (and maybe their kids) to get athletic scholarships, it sounds like the risks far outweigh a diminishing return.

In all fairness, I used to go to camps to get some instruction and frankly, to see how I compared with the best around the country. Now, instruction is mostly found in one-on-one sessions because all the camps are more “showcase” in nature so the kids can get exposure to as many schools as possible.

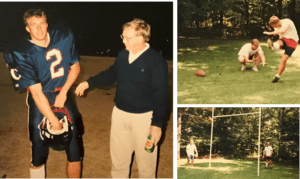

And of course my parents support was instrumental in my preparation to play at a high level. My dad built a goal post in my front yard when I was 11, then he narrowed the width between the uprights when I was 14 to help improve my accuracy. I even recall a bucket truck coming out to the house one Christmas season to hang a net behind the goal post to keep the balls from always going into the woods; it worked for a while until kicking the ball over the net became the standard for a “good kick.” I went to one or two camps each summer and there are still 20-something deflated and warped footballs in the attic of the house I grew up in. Looking back, my parents probably spent less than $5,000 on my football career between the time I turned 9 and my graduation from high school. That would have barely made a dent in the cost for me to have attended the University of Tennessee. My athletic scholarship was worth around $40,000 from the time I started classes in the fall of 1994 to my graduation in December 1998 (about $104,000 today). My parents investment in my football career was a small price to pay for a life-changing experience not to mention the social capital I developed in a community that embraced me like a family member. Ultimately, collegiate athletics changed the trajectory of my life, but of the 2% of high school student athletes that get any money for college, I’m an even more rarity because I didn’t have to give up my summers, my youth and most importantly, my body to lifelong injuries. In investment parlance, my story as a student athlete would be akin to someone starting a company from scratch and years later watching it get listed on the New York Stock Exchange.

There’s a unique feeling of walking out onto a football field knowing that all eyes are on you and that in the moments to come, you will be both loved and despised. The overall experience can be maddening because of the emotional difference between a make and a miss and at that point, the running, lifting, charting, mental preparation and monotony of one kick after another in practice comes to fruition. As Bud Ford, our sports information director at the time, used to tell me from time to time, “Jeff, you’re only as good as your next kick.” It was a helpful reminder that by the time I stepped on the field, it was too late to prepare. The complexities that come with life’s transitions are similar; by the time they arrive, it’s too late to prepare for them, too. New risks unfold that were never considered beforehand, expenses increase, new taxes have to be accounted for, our health deteriorates and if things weren’t complicated enough, family dynamics can become increasingly difficult to navigate due to any number of reasons. It’s certainly hard to prepare for the unknown, but meaningful conversations about what life looks like in 5 or 10 years, for example, can help us plan and prepare now so that life can be full of what truly matters instead of throwing hail mary passes to make up for lost time.