Articles

Defense Wins Championships: Bonds and Your Portfolio

12.03.2021

Tennessee legend Peyton Manning was enshrined into the Pro Football Hall of Fame in 2021 after a career including 14 pro bowls, 539 touchdowns, and 2 Super Bowls. Peyton will always have Super Bowl 50 on his resume with the Broncos. However, most headlines’ primary focus after the game was on the MVP, Von Miller: a defensive player. As it turns out, the Broncos didn’t need a high-powered offense to achieve their goal. Manning only attempted four passes in the fourth quarter. To anyone watching, this strategy made perfect sense. Why call riskier plays when your defense has the ultimate goal within reach? This same question can also apply to your retirement portfolio and bond allocation.

In today’s ultra-low interest rate environment, bond returns are sometimes referred to as “pathetic” or “bleak” by media members and even Warren Buffett. Why? Because they are. However, there is an easy argument to be made for why bonds still belong in portfolios.

First, let’s make sure we understand the basics of bonds and bond funds. At a fundamental level, a bond is a contractual loan to an entity in exchange for interest and the eventual return of capital. You are letting the entity pay you for the use of your money. The market price of the bond will work inversely with interest rates. If interest rates rise, the bond price falls, and vice versa.

So, how do retail investors purchase individual bonds? Most don’t. Buying individual bonds is a very different process than purchasing stocks. Bonds are illiquid, have high minimum purchase amounts, and compete with large institutional buyers for allocation. The good news is you don’t have to compete with institutions – you can join them. A bond fund is an investment vehicle that purchases a basket of bonds. These are often in the form of an ETF (exchange-traded fund) or a mutual fund. These vehicles are often easier to find/understand, are liquid, and do not have minimum purchase amounts.

So why have bond exposure? The answer to this question becomes easy once we stop looking at bonds as a way to make money but instead as a way to preserve capital.

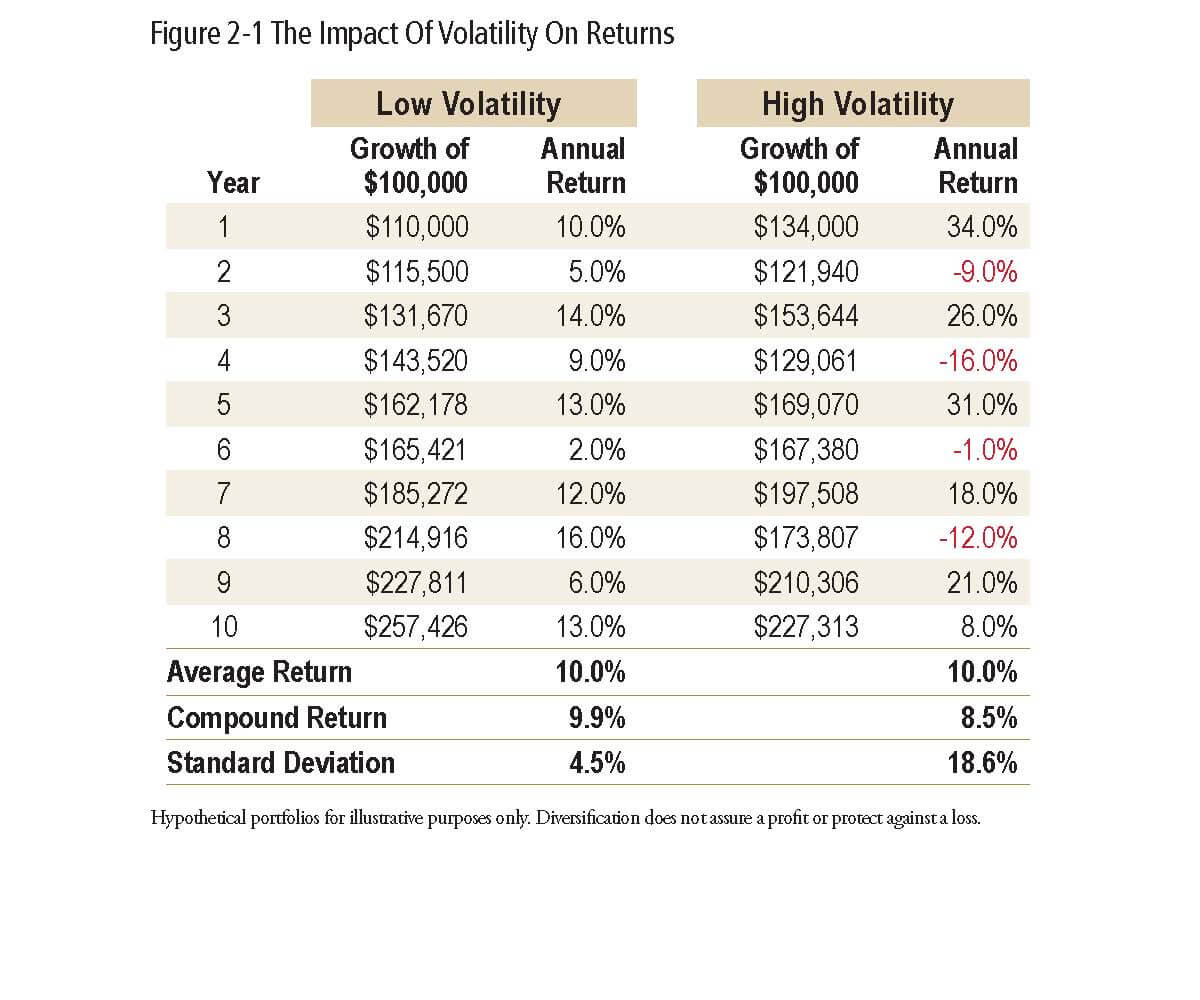

Few understand the following: a portfolio down 30% requires about a 43% return to get back to even, while a portfolio down 9% only requires a 9.9% return to recover. If the loss is significant, then future compounding must work with a smaller base. Take a look at the below example from the book The Investment Answer by Daniel Goldie, CFA, CFP, and Gordon Murray.

As you can see, both portfolios have an average return of 10%, but the low volatility portfolio ended up with more wealth because of the higher compounded return.

How much do quality bonds fluctuate? In Q1 2021, the US Bond Market had its worst quarter since 2001 at -3.4%. Comparatively, the worst US Stock Market quarter of -22.8% was in Q4 2008.*

Additionally, bonds provide what’s called a negative correlation to your portfolio – a simple risk management concept that involves the prices of two investments moving in opposite directions. For example, if you watched Super Bowl 50, you saw the Broncos struggle on offense at times, but solid defense won them the game. The same concept can apply to your portfolio. Historically, while stocks struggle, bonds performed well.

The proper mix of offense and defense in your retirement portfolio can ultimately lead you to a championship (retirement). The final question remains: What is the correct allocation to bonds for my portfolio? Give Rather & Kittrell a call today, and let’s find the answer.

Sam Paganelli, CFA® is an Associate Advisor with Rather & Kittrell. Sam is available at [email protected].