Articles

Real-Life Rebalancing

01.28.2022

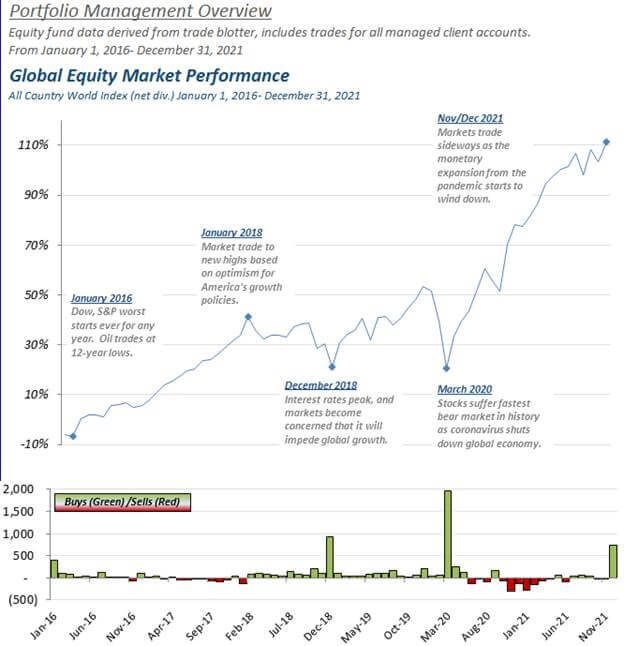

The end of 2021 marked my sixth full year of trading for wealth management client portfolios at Rather & Kittrell. The six years saw no less than two presidential elections, two global selloffs, Brexit, an interest rate hiking cycle, a global pandemic, and the return of inflation. And those are just the events that I can rattle off the top of my head. While the trading volume wasn’t quite as large as Q1 2020, there were still many events in the markets and opportunities captured. That is part and parcel of both the value that we offer clients and of our rules-based, systematic approach to monitoring our client accounts. The chart below gives a high-level view of how we managed allocations through the years and some notable events during that time frame.

The chart data is taken directly from our portfolio management software and reflects all the trades over six years. The illustration includes all the asset classes we hold in our client portfolios, such as Emerging Markets, US Large Companies, International Stocks, etc. When reviewing and determining what asset to purchase, we look to see which is most out of balance, or in other words, which component is doing poorly compared to the others. This allows us to buy segments of the equity market that are lower rather than purchasing those that have performed the best.

It is easy to spot on the chart, but even as the global markets continued to move higher through 2021, a large volume of purchases took place for client accounts. But rather than buying US Stocks while they are flirting with all-time highs, the vast majority of purchases were in the unloved and downright hated sectors of the market like Emerging Markets, International Developed, and International Small. This has nothing to do with our feelings about the prospects for US equity markets. It is to keep our portfolios within the range for their long-term allocation. Of course, we still own US stocks, and we will likely always have a meaningful allocation towards them. Still, there is a whole world of opportunity in markets, and investors quickly forget that there are periods, even an entire decade, where US stocks were down (2000-2009).

Our trading process doesn’t rely on inside information or secret knowledge about when the market would make a turnaround. We review accounts and determine if the allocations are inside or outside of the pre-determined guard rails. If they are out of drift, we remedy the situation by placing trades. We purchase when below the threshold and sell when above. If no trading is required, we sit tight until the next review period. No outside influence or internal beliefs dictate when we are buying or selling for our clients. The price action in the market and our clients’ long-term financial goals guide our trading decisions.

Portfolio management is not as simple as buying and holding forever, or is it trying to time the market or predict the future, which is impossible. Investments fluctuate in value, and over time making no adjustments can lead to more exposure to risk than when you started. Our philosophy isn’t passive or conventionally active in how the financial media would lead us to believe is essential. A rules-based approach that is disciplined and takes the emotion out of the equation has allowed us to take advantage of changes in prices while maintaining a consistent level of risk unique to each of the families we serve.

We all know that money is made by buying low and selling high. Unfortunately, our emotions can tempt us to do just the opposite in the heat of the moment. Because our clients have an investment policy statement in place, we already know how we will respond before the next crash or boom occurs. While we cannot predict the future, we have put in place a rhythm of buying as prices get lower and trimming profit as investments grow. As years turn into decades, these small adjustments compound and produce a plan for our clients that will stand the test of time.