Articles

Have You Ever Seen the Rain?

01.31.2022

While driving around town, I’ll often change the radio station to the classic rock channel. While I have a hard time remembering the names of the bands, I can sing along with most of the songs from memory. I remember listening to those songs in my parent’s car during road trips. One band that I remember fondly is Creedence Clearwater Revival, and one of their classics, “Have you ever seen the rain?” It’s interesting to look back on what they are talking about in the song since the first time I heard this was probably only five or six years old. The first stanza begins with this phrase:

“Someone told me long ago, there’s a calm before the storm.

I know, it’s been coming for some time.”

One of the questions people always ask is when I think the market will have the next big move. For the last five years or so, I have given the same answer. Of course, I have been expecting the market to fall for the last few years. But really, what people are asking me is what I should do about my investments if the market goes down. The idea of trading in and out of the market to avoid dangerous times keeps market timing services in business and will probably continue to do so well into the future.

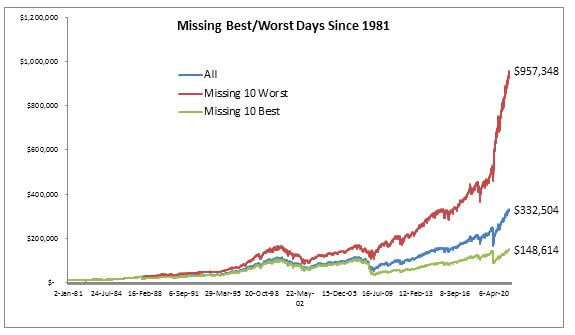

Whether investors realize it or not, there is always a cost to trying to time the market, and two correct decisions must happen. The first is when to sell, and the much harder decision is when to get back into the market. Of course, it doesn’t help that those trying to time the markets usually make these decisions when volatility and emotions are running at extremes. By now, most investors are familiar with the charts that talk about how returns are affected if you miss the ten best-performing days. I want to further show how performance can be affected by missing the best days and avoiding the worst ones.

As the chart demonstrates, it is imperative that you do not miss the best days, but that you should also avoid the worst days. Sounds easy enough, except when you dig down and look at just what that entails in terms of trading around some of the craziest market events in the last 40 years. Without diving into them all, I will illustrate the difficulty by analyzing the events in March 2020.

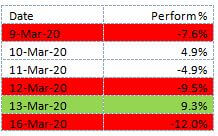

So in six trading days in March 2020, the market saw 3 of its ten worst days and 1 of the ten best days. To miss these worst days, you would need to do the following:

It may seem alluring to avoid some of the most painful days in the markets and keep your portfolio from getting rained on, but unless you are the best weatherman in the markets, your portfolio will see rain from time to time. With all that has happened over the last eighteen months and the rebound the markets have experienced, everyone knows that the rains will come again someday. It might be next month or next year, but no one knows when it will happen. And there isn’t a person alive that can trade in and out of volatile times without getting a little wet. The answer is to develop a plan that provides shelter through the storms and realize that it’s impossible to have long-term success timing the market, no matter what people tell you.

Nathan Smith is a Portfolio Manager with Rather & Kittrell. Nathan is available at [email protected].