Articles

2008 Again?

03.17.2023

Is it 2008 all over again? Should we be worried about the financial system collapsing?

Deep breath. Let’s discuss.

On March 10th, Silicon Valley Bank (SVB), a bank catering to startups closed its doors after it could no longer cover withdrawals.1

Days later, regulators also took over Signature Bank.

There’s reason to believe a number of other banks may be in trouble.2 Rising interest rates are hitting many banking portfolios hard and weaknesses are emerging.

Should we be panicked about these bank failures?

No. Here’s why:

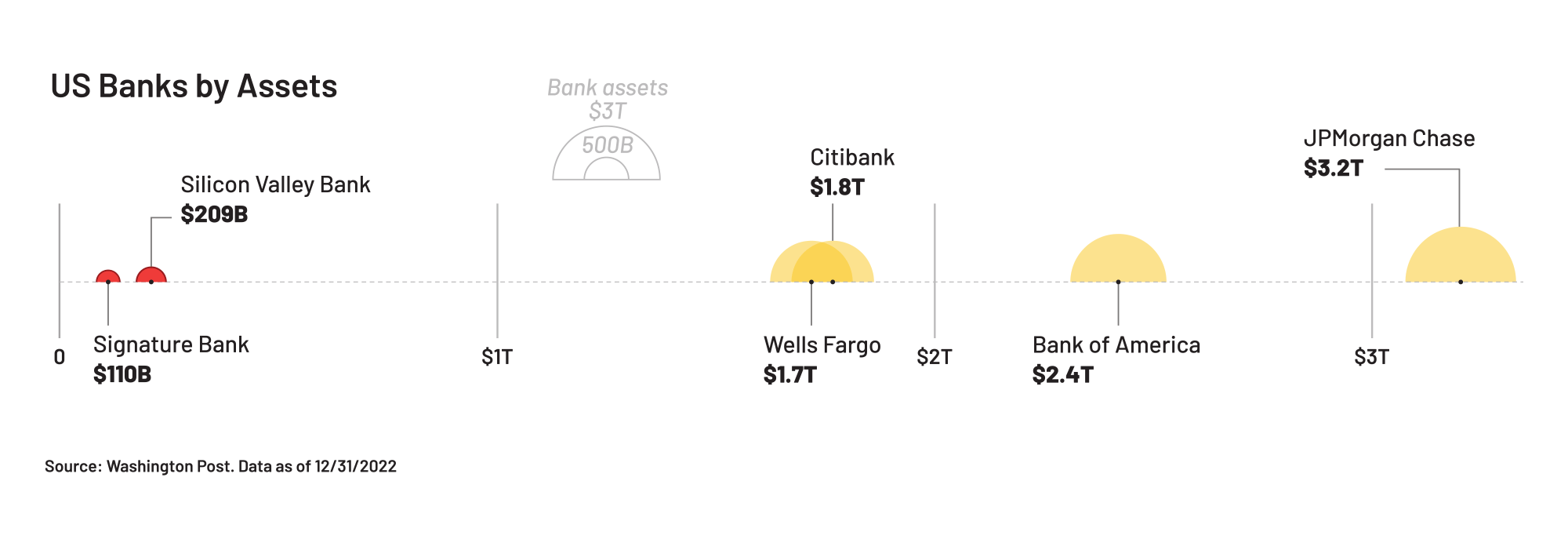

The affected banks are small in the context of the overall banking system.

You can see in the chart above how small the two failed banks are relative to other, larger financial institutions.3

They also serve high-risk niches. These banks have a lot of exposure to cryptocurrencies, startups, and other highly volatile asset classes.4

Those risky assets can make them more vulnerable to bank runs and liquidity issues. Which is what we’re seeing happen.

Will more banks collapse?

That’s very possible. Moody’s, a rating agency, reported that it’s watching several other institutions with potential problems.2

Some larger banks may be affected as well, but it looks like regulators are stepping in quickly to protect the overall financial system.

What can we take away from the SVB failure?

I think it’s a good time for one of Warren Buffett’s famous bits of wisdom:

“Only when the tide goes out do you discover who’s been swimming naked.”

What he means is that adverse conditions expose vulnerabilities and risky choices. Many strategies can look brilliant when markets are booming. You don’t always know or appreciate the risks until conditions turn against you.

Clearly, a number of institutions are finding that out.

I think there’s a lesson here for us as well:

When times are good, we might not worry too much about our income or our expenses. Or the risks we take in the market.

But when times get tough, we start appreciating the risks we’ve taken and the obligations we’ve taken on.

Understanding our actual tolerance for risk and our ability to withstand rocky times is absolutely critical.

It’s very hard to do when the sun is shining and life is good. But it’s a skill well worth developing because we can expect to experience bear markets, recessions, and uncertain conditions throughout our lives.

Markets are reacting badly (as they usually do) to the uncertainty and we could see continued volatility.

Handling the stress of added volatility in markets is much easier to do when you have a sound financial plan that accommodates for these types of markets.

If you have questions or have any friends or family who are worried or about to make some financial moves because of the headlines, will you send them this email or ask them to reach out to us?

These are the times when an objective, professional take can help folks understand their options and make good decisions.

We’re here to help.

Sources:

1. https://www.cnn.com/2023/03/13/investing/silicon-valley-bank-collapse-explained/index.html

2. https://www.cnbc.com/2023/03/14/moodys-cuts-outlook-on-us-banking-system-to-negative-citing-rapidly-deteriorating-operating-environment.html

3. https://www.washingtonpost.com/business/2023/03/13/bank-failure-size-svb-signature/

4. https://www.cnbc.com/2023/03/12/regulators-close-new-yorks-signature-bank-citing-systemic-risk.html

Chart source: https://www.washingtonpost.com/business/2023/03/13/bank-failure-size-svb-signature/