Articles

Act Your Wage

12.03.2021

It’s no secret professional athletes can struggle with money. As a Tennessee Titans fan, I remember the hype surrounding newly drafted QB Vince Young. I also remember being at the game when he threw his shoulder pads in the stands four years later, essentially marking the end of his career. Between these two instances, Young reportedly earned around $60 million between salary and endorsements. Fast forward to 2014, and Vince found himself in bankruptcy court amid reports of a $300,000 loan for a birthday party, a $15,000 Cheesecake Factory bill, and a $1.9 million loan at 20% interest. On a similar note, former NBA superstar Allen Iverson allegedly spent his entire $200 million career earnings due to excessive spending habits. One instance he reported was when he forgot where he parked at an airport, called a cab to a car dealership, and bought a new car. Unfortunately, the list of these instances can go on and on. While these illustrate extreme examples, data continues to show the concept of living beyond your means can be found in any socioeconomic group.

More specifically, this trend is seen in most Americans’ non-mortgage debt. On average, American’s owe $5,500 in credit card debt, $39,000 in student loans, and $20,000 in auto debt. The statistics show it’s normal to live with these debts, but does that mean you should? I’ve heard an analogy referring to debt as a slow fire. Some people can stand the initial heat, but it can take the oxygen out of your financial picture if you don’t stamp it out. So, what can you do to stop the fire?

The first step is to correct the behavior. For example, would you immediately go back into debt if someone waved a magic wand and eliminated all your non-mortgage debt?

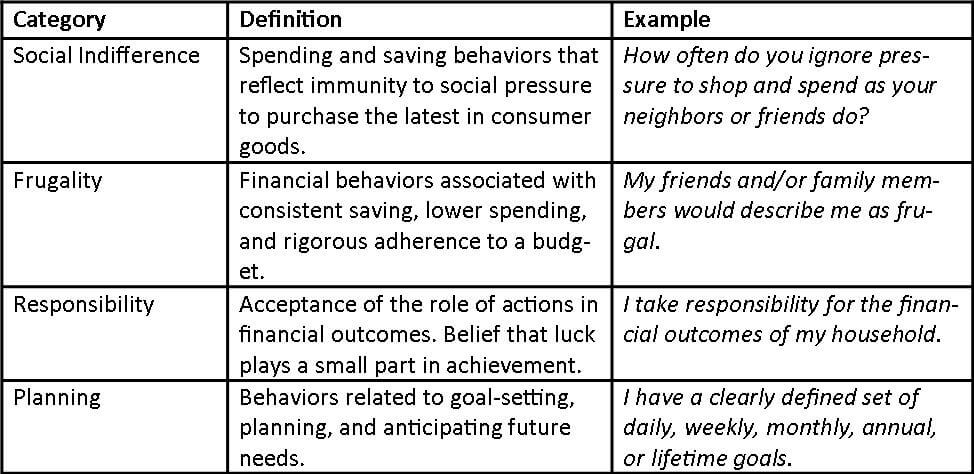

The 2016 study of the average millionaire in the book The Next Millionaire Next Door by Thomas Stanley, Ph.D. and Sarah Fallaw, Ph.D. show the following traits that are crucial to building wealth and eliminating debt:

The second step involves creating a system and executing it. Sit down with your significant other and list your debts. While it sounds simple, most couples admit it can be a jarring experience to face all obligations written down on paper. Once you know the amount of debt you need to conquer, the rest becomes building a repeatable, consistent system to attack it. Math would suggest paying high-interest debts first, and behavioral finance would propose paying off your debts from smallest to largest. But, your future self should recommend just get started!

When you pay off your first debts, feelings of “I can do this” begin to materialize. These feelings provide the discipline to stay the course, and you should hold on to them. Once you start to eliminate debts, more cash flow materializes to attack the next debt. It can have a compounding effect when this happens, and before you know it, you are debt-free. This newfound cash flow gives you the option to fund retirement and live the life you always hoped to live.

Ultimately, your ability to build and grow wealth is shaped by you. Paying off debt can be abrupt and uncomfortable, but focusing on a consistent, repeatable system will guide you through the process. Sure, you could continue to live with debt. The average American does. However, the average American’s financial picture remains just that: average. So, if the fastest way to wealth is to eliminate debt, why not get started today? Your future self will thank you.

Sam Paganelli, CFA® is an Associate Advisor with Rather & Kittrell, Inc. Sam is available at [email protected].