Articles

Clipboard & Checklists

09.29.2023

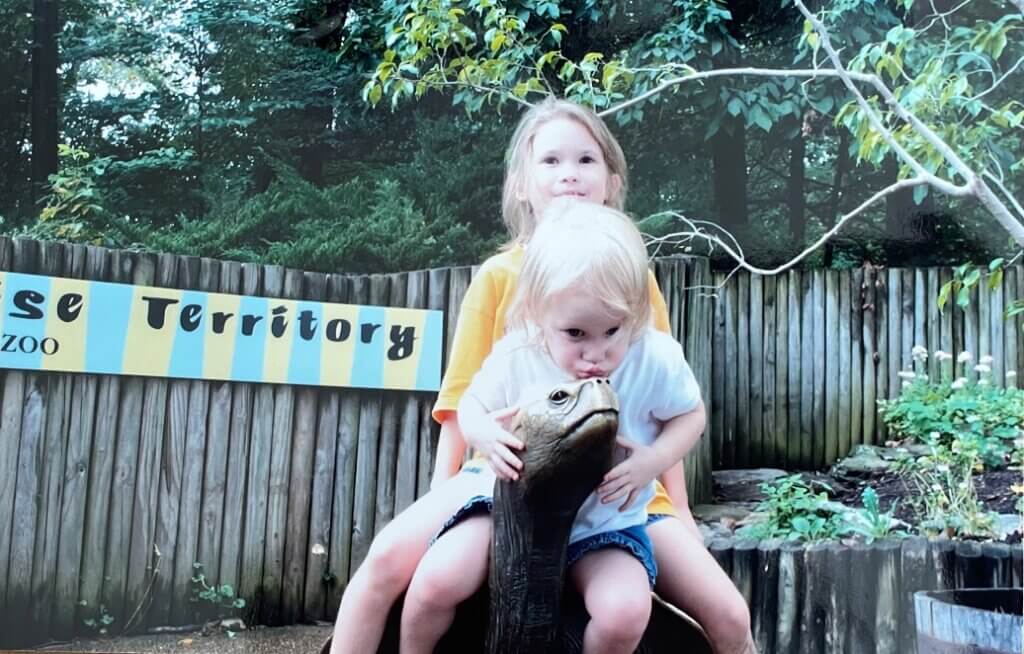

My grandmother used to take me and my cousins on “cousin field trips”. We went to Mayfield Dairy Farm, The Lost Sea, the Knoxville Zoo, and the Sunsphere, and we all have fond memories of the days of cousin field trips.

My grandmother used to take me and my cousins on “cousin field trips”. We went to Mayfield Dairy Farm, The Lost Sea, the Knoxville Zoo, and the Sunsphere, and we all have fond memories of the days of cousin field trips.

I recently learned that I was notorious for showing up with a clipboard and “taking notes”… before I was old enough to read or write. No one knew where I got the clipboard, which adds to the hilarity of a four-year-old with a clipboard in the midst of the other kids playing and yelling while my brave grandmother corralled us throughout the day.

As a financial advisor, I talk with many people who may have been fellow four-year-old-note-takers given their propensity for planning. I consistently hear questions about ensuring they are not missing anything financially and ensuring they are setting themselves up for success. Given my history with a clipboard, it’s no surprise that after hearing these questions, I made a checklist.

This checklist is a great place to start when you are getting your finances in order. It includes a section for those of us who are planning ahead and a section for those of you who are approaching retirement. We’re here to help if you have questions about these action items.

Planning Ahead: Action items that are critical to ensure you are prepared for retirement, even if you are planning for retirement in 10+ years

- Emergency fund: build up cash savings for your emergency fund. A good rule of thumb is 3- 6 months of expenses, but the amount of cash that you need to have peace of mind may be more.

- Debt management: pay down high-interest debt and create a plan to manage low-interest debt.

- Understand your expenses: understand how much you are spending on fixed and discretionary expenses. This will help you create spending goals for retirement.

- Create and examine your goals: what would you like to do in retirement? How much do you want to spend in retirement? When do you want to retire? We have found that the most successful retirees have an idea of what they want retirement to look like, rather than only the idea that they want to stop working.

- Save accordingly with tax efficiency and investments in mind: contribute to a retirement account, ensuring you are taking advantage of any match that your employer offers. Consider if pre-tax or Roth contributions make more sense for you. Consider investing in an investment strategy that ensures you are diversified and have exposure to an appropriate mix of stocks and bonds.

- Engage spouse: engage your spouse with the items involved in this checklist so that you are on the same page and are prepared if something were to happen to one of you.

- Insurance: review your insurance coverage (life, disability, property & casualty) to ensure you have adequate coverage but are not overpaying.

- Estate Plan & Beneficiaries: create a basic estate plan including health care directives, and ensure that the beneficiaries on your accounts align with your wishes.

Approaching Retirement: Additional action items for when you are approaching retirement

- Refine your goals: Refine your plan for how you want to spend your time in retirement and how much you want to spend on categories such as basic expenses, travel, giving, and vehicle replacements.

- Social Security: Utilize www.ssa.gov to obtain estimates of your social security benefit.

- Investment Accounts: Plan for how you will draw from your various accounts in retirement, how this will correspond with other income you will have, and how you will adjust your investment strategy accordingly.

- Medical Expenses: learn how Medicare will work for you and ensure you have a plan for health insurance before Medicare if you are retiring before age 65.

- Long Term Care: consider potential future long term care expenses and decide if purchasing long term care insurance or self-ensuring makes more sense for you.