Articles

Ensuring Your Financial Legacy

12.03.2021

For many, death is not an easy subject to discuss. No one wants to talk about making plans for after they pass (see, I’ve already moved to more palliative language). But, if I were to be a betting person, I think most of us would like to live healthy, fulfilling lives until we are gray and slowing down. Then just one night peacefully drift off into eternity while holding our loved one’s hand (who is also peacefully taking this step with us).

Life and death don’t happen that way. Sometimes death is a surprise with absolutely no warning, while other times, the end is known. But, no matter how it happens, death ultimately comes for all of us. And, because we know this is inevitable, we need to make plans for what happens with our physical and financial possessions.

Unfortunately, if you do not make plans for your physical and financial possessions, the state in which you live will called intestate.If you own any assets in your name with no named beneficiaries, your surviving loved ones could be amazed at how the state handles those assets. In addition, states do not care if minor children are involved; minor children can own a home with their parent or a step-parent.

Thankfully, putting a plan in place is not hard. The most straightforward plans include naming joint owners (with survivor rights) and beneficiaries of any assets. Any joint with rights of survivorship accounts will automatically pass to the surviving owner upon the first owner’s death. Naming a beneficiary also is easy as the named beneficiaries will automatically receive the inheritance. No wills or trusts are needed for this type of transfer. And, for many people, their primary assets are owned jointly with spouses (a home), and their retirement accounts have named beneficiaries (typically part of the initial paperwork). A quick note regarding beneficiaries: if you have significant life changes such as a divorce, beneficiaries should be updated. In some situations, ex-spouses have inherited money since the beneficiaries were never updated.

As simple as joint ownership and beneficiaries sounds, it is still usually best to sit down with an estate attorney and create a will (and possibly a trust) that outlines your wishes. Estate documents can create provisions that help make sure minor children don’t have access to money too soon, ensure generational assets are passed down through your lineage, and ensure creditors cannot unjustly come after the finances.

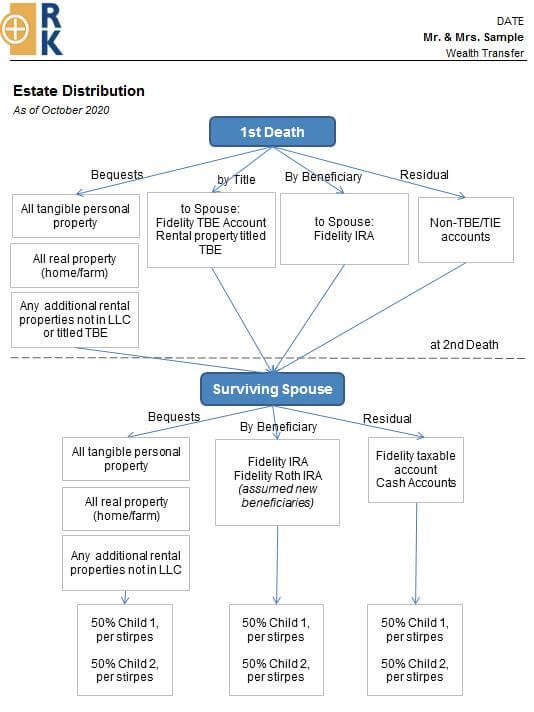

Finally, after estate documents are finalized, we recommend sharing these with your financial advisory team. Your team at Rather & Kittrell will review the information, make sure your accounts are titled appropriately, and make sure your named beneficiaries match your estate plan. The team can also create a flow chart that simplifies how money passes.

More importantly, your RK team will be there to walk hand in hand with your surviving loved ones. Our goal is to be thoroughly acquainted with your estate plan; this will allow us to help your spouse set up the appropriate accounts or trusts, make sure cash continues to flow to your spouse, and assist your children in understanding any available inheritance when the time comes. During their time of grieving, we want to be the “easy button” for all these finances.

While we acknowledge that planning for our eventual passing can be challenging, we like to reframe the discussion in terms of planning for the financial well-being of your surviving loved ones and the financial legacy you’ve worked so hard to create. We want to join you on that journey and help your loved ones thrive in that legacy.

Legacy picture with my Nana (at her 95th birthday), my mom, and my sister.

Amanda Howerton, CFP®, CDFA® is a Senior Advisor with Rather & Kittrell. Amanda is available at [email protected].