Articles

Important Details - The American Rescue Plan of 2021

06.18.2021

The American Rescue Plan of 2021 is a bill with plenty of provisions for sending cash out to millions of Americans. Some Americans have already received another round of stimulus payments. And many American families are about to start receiving money monthly for their children as part of the expanded Child Tax Credit program for 2021.

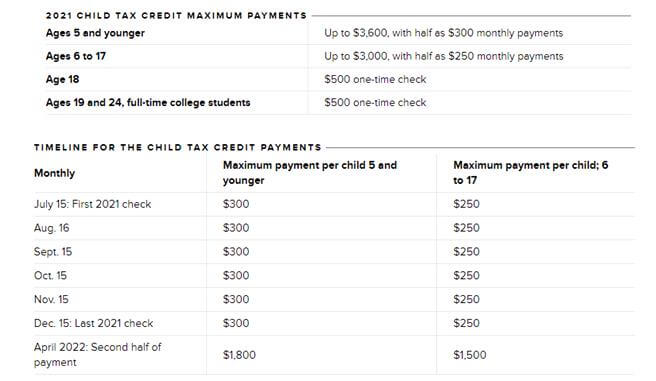

In July, millions of families will receive monthly payments (July – December) that will equal approximately 50% of the child tax credit for which they are eligible for the 2021 tax year. As part of the American Rescue Plan, these advanced payments also coincide with expanded tax credits. The child tax credits for the last few years have been $2,000 per qualifying child.

The maximum new credit is $3,600 per child age five and under (as of 12/31), $3,000 for ages 6 to 17, $500 for a child age 18, and $500 for ages 19-24 if a full-time student. The expanded tax credits begin to phase out with incomes of $150,000 (married filing joint or qualified widows/widowers), $112,000 (heads of household), and $75,000 (all other taxpayers). The base $2,000 child credit does not begin to phase out until $400,000 (married filing joint).

Headlines are making it known the cash payments are coming, but few articles are diving into are the implications of what the advanced payments truly represent. These payments are the taxpayers’ credits typically claimed when filing the tax return between January – April of the following year. The amount of tax credit received in July – December will reduce the credits come 2022 tax season.

Example: A married (filing joint) couple has two children aged 4 and 7 and qualifies for the entirety of the child tax credits in 2020 and 2021. In 2020, the couple had a $4,000 child tax credit to reduce their income tax bill; assuming their tax liability was $3, 500 they now have a $500 refund ($3,500 – $4,000). In 2021, they receive 50% of their child tax credit via payments in July – December totaling $3,300 ($300/mo for 4 year old and $250/mo for 7 year old); now, they only have $3,300 of their tax credit remaining. If you assume the same tax liability of $3,500, this couple owes the IRS a check for $200 for the remainder of their tax bill ($3,500 – $3,300). The couple may be just fine writing the check for the refund, but they also may be used to taking the tax refund to go on vacation or pay off bills.

Some folks will be happy to have the extra cash payments given all that happened in 2020 and 2021 during the pandemic, but it would be wise to consider setting aside at least a small portion of the tax credit if a tax bill comes due in April.

For couples who do not want the monthly July – December payments (and want to make full use of their tax credit in April), the IRS is creating an opt-out portal. That portal should be available around June 30th, and our team is continuing to watch for developments.

If you have questions about the changes in the tax credit for your own tax situation or if you have adult children who this may affect, please share this article, and feel free to reach out to us. We are here to help.