Articles

Markets Always Move First

07.28.2023

Are we in a recession? I have heard adamant answers ranging from “No!” to “Yes!” to “We will be soon” to “We were last year.” The uncertainty surrounding this issue is evident, even among experts. In a press conference this week, the Federal Reserve chair, Jerome Powell, declared that the Fed was no longer forecasting a recession for the US economy. This reversal came after their initial prediction was made in March of 2023.

This seemingly simple question doesn’t have the straightforward answer many have sought. The commonly held perception of the definition of a recession is two consecutive quarters of negative gross domestic product (GDP). If this were the official definition, we would have been in a recession after the first and second quarters of 2022. However, a recession has not officially begun until a group of economists, the National Bureau of Economic Research (NBER), declare the recession.

NBER defines a recession as a significant decline in economic activity spread across the economy, lasting for more than a few months.

But perhaps more important than knowing NBER’s definition is knowing that the market moves first. The market constantly processes new information, pricing in expectations for companies and the economy. It is not waiting for the NBER, or anyone else, to rise or fall.

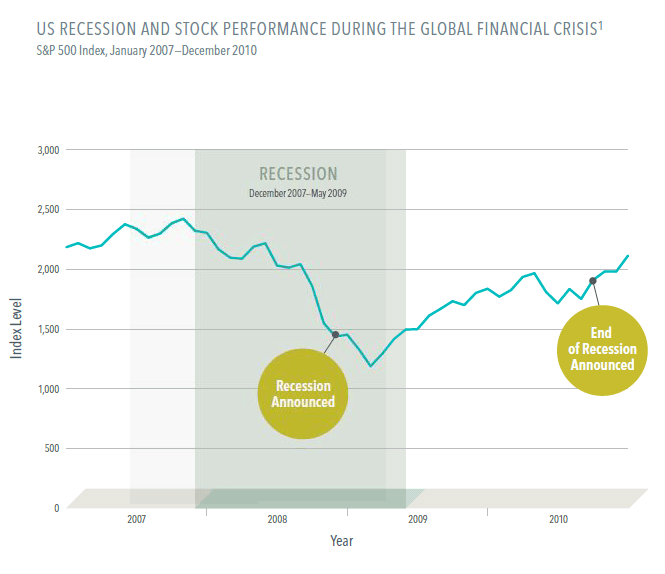

The global financial crisis of 2007-20009 stands as a striking example of the disconnect between market realities and the timing of official recession declarations. Signs of trouble emerged in 2007 as housing prices declined, financial institutions faced mounting losses, and credit markets froze. Yet, the NBER officially announced the recession’s start in December of 2008 – a year after the crisis began. By then, stock prices had already dropped more than 40%, reflecting expectations of how the crisis would affect company profits.

Not only that, but we now know that the recession ended in May of 2009, but the “end of recession” announcement came a full 16 months later, in September of 2010. US stocks had started rebounding before the recession was over and continued to climb through the official announcement.

The market doesn’t wait for official announcements.

Investors who focus on their long-term plans rather than being swayed by after-the-fact headlines are better positioned for the future.

Instead of fixating on whether we are in a recession, a more pertinent question for everyone is to understand what truly matters to them and align their use of capital with those priorities.

As financial advisors, it is our responsibility to guide and support our clients through uncertain economic times. Our commitment is to empower our clients with knowledge and personalized advice to help them achieve their financial goals and secure a prosperous future. We are here to help.