Articles

New Bull Market?

06.16.2023

A new deal finally put the debt ceiling issue to rest (for now, anyway), and stocks are rallying.

Are we on the brink of a new bull market?

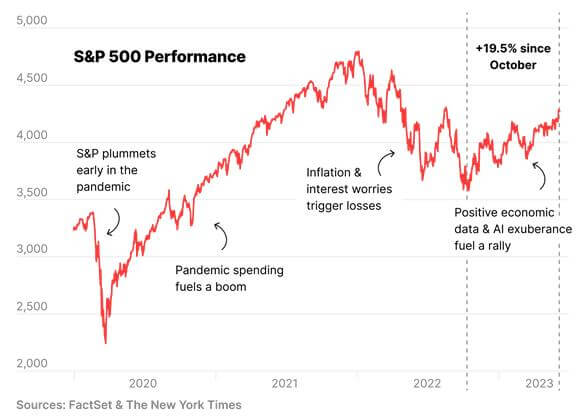

We might be. The S&P 500 has soared in 2023 and is up over 20% from its October 2022 low.1

That’s pretty surprising given the concerns about interest rates, recessions, banks, and a war in Europe, so some analysts remain wary.

How do we know when we’re in a bull market?

First, let’s acknowledge that the terms “bull” and “bear” are just shorthand for general market trends and don’t necessarily mean anything scientific.

Generally, a 20% decline from a market high defines a bear market. (You might remember all the headlines from 2022 when the current one started.)

However, bull markets are a little harder to call.

A 20% increase from a bear market low doesn’t necessarily kick off a bull market.2

Since a 20% increase still leaves you shy of the original market high, many analysts don’t consider it a proper bull market yet.

They want to see stocks achieve a new historic high before officially calling an end to the bear market.3

We’re not there yet.

But, it’s probably fair to say that we’re flirting with a bull market.

What’s driving the recent rally?

Here’s where analysts have some concerns.

The recent rally centers around a few big tech stocks and seems to be energized by enthusiasm for artificial intelligence.

That means the rally lacks breadth. Your average S&P 500 company has only seen gains of less than 3% this year.3

The fact that the rally relies on the performance of a few high-flying stocks could spell volatility ahead.

What should I expect in the months ahead?

Hard to say. Markets seem to have momentum and we could see the rally continue.

However, recession and interest rate concerns are still bubbling under the surface, so let’s not break out the party favors yet.4

Let’s celebrate just how far we’ve come since the bear market began last year, but stay flexible enough to accept any pullbacks and volatility that might lie ahead.

Sources:

1.Yahoo Finance. S&P 500 closing price performance between October 12, 2022 and June 5, 2023.

2.https://www.axios.com/2023/06/06/us-stock-market-bullish-vs-bearish

3.https://www.nytimes.com/2023/06/05/business/stocks-bull-market.html

4.https://finance.yahoo.com/news/recession-talk-rages-on-despite-robust-jobs-market-191308453.html