Articles

Urkaine, What's Next

02.25.2022

As if the last two years of living through a global pandemic weren’t enough, now we are watching a war break out between Ukraine and Russia. The invasion of Ukraine is a serious and an unsettling escalation in tensions between Russia, Europe, and the United States. We wanted to provide some perspective on the situation and possible implications for the markets and our economy.

Before we dive in, let’s take a moment to think about the folks who are suffering and dying in Ukraine as well as the ordinary Russians who will suffer from sanctions, instability, and economic damage. Let’s hope and pray that diplomacy can end this crisis.

So, what are some possible implications for markets and our economy?

Given Ukraine’s critical pipelines and Western sanctions on Russia, the crisis has already led to higher energy prices, which is trickling down to higher pump and heating fuel costs.1

Sustained price increases could hamper the Federal Reserve’s effort to control inflation, so we’re keeping an eye on that as well.

What could happen in markets? More volatility, as we’ve already seen so far, is likely.

What does history teach us about market reactions to geopolitical shocks?

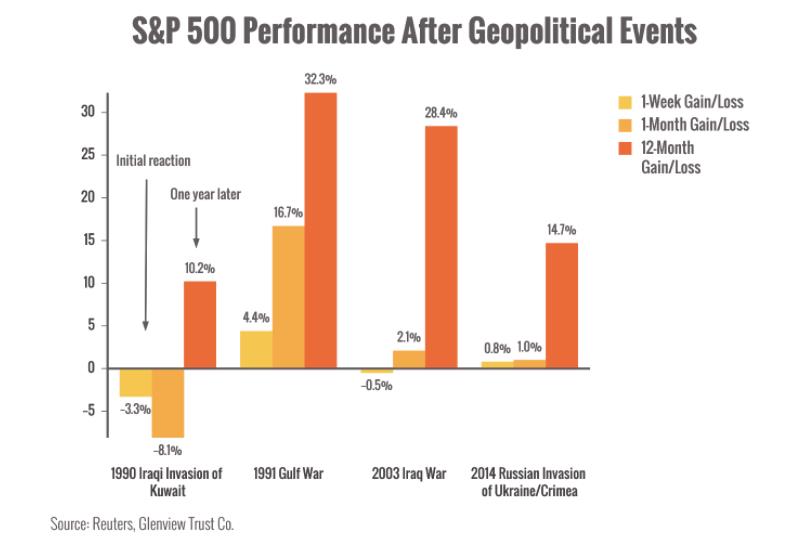

History shows that stocks usually recover quickly from geopolitical crises. I’ll add a disclaimer that the future doesn’t perfectly match the past — but it often rhymes. Let’s take a look at some examples from other invasions and wars:2

Here’s the key takeaway: short-term, markets usually react badly. However, a year later, markets have historically recovered.

Will they always? In every case? That’s impossible to say. But, the larger study of 29 geopolitical events since WWII shows a general trend toward short-term losses within the first month and longer-term gains.2

“Geopolitical event” is a very antiseptic phrase for things like bombings, wars, invasions, and other horrific attacks, and really fails to encompass the full cost in human misery.

The bottom line is that we never know what happens next in these situations. We can hope, pray, donate, and speak out.

And we can focus on what’s in our control: ourselves, our actions and reactions, and our strategies for uncertain times.

1 https://www.nytimes.com/2022/02/27/business/oil-prices-russia-ukraine.html