Articles

Words Matter, Or Do They?

02.18.2022

Did you get the word? How many guesses did it take? These are some common questions that I’m hearing around the office and among my friend groups these days, as everyone has become semi-obsessed with Wordle. The game has even been responsible for saving a kidnapping victim in Chicago when family members were concerned when she didn’t send her daily score.

If you aren’t familiar with the game, stop what you are doing and play it. You will thank me later. The rules are straightforward, guess a five-letter word in six attempts. If you have a letter in the right place, a green tile will appear. The correct letter in the wrong place the letter will have a yellow background. A grey box appears for an incorrect letter. It looks something like this. While opinions on the internet vary, the consensus is at least 2500 words are available in the World lexicon, which will probably increase at some point.

Listening to friends and colleagues describe their gameplay and style seems all over the map. Some take the Wheel of Fortune method, where they look at creating a word with R, S, T, L, N, E. Others like to start with a word with many different vowels like ADIEU, hoping to gain some insight into how many vowels the word contains. Finally, some intrepid programmers have taken it upon themselves to build algorithms that try to determine the best starting word that will solve the puzzle in the fewest number of attempts.

Many people think that using an algorithm to find the word withthe highest probability of success takes the fun out of the game. They fail to understand that even if you use a successful algorithm, you will play many games without victory. The number of trials used to determine the probability measure in the thousands.

Is there anything we can take away as investors when looking at different strategies for games like Wordle?

Observing and doing a fair amount of research Wordle strategies brings to mind how different investors view the market. Some believe the markets are simply a solvable puzzle, while others are content to ride the waves as time goes along. It is the classic debate of active versus passive. Our philosophy leads us to take the approach of the programmers that try to find evidence and data to support their conclusions, and to find an approach that over time lends itself to higher probabilities of success, or in our case, that will lead to excess returns in the markets. These factors are pervasive, persistent, and cost-effective and they have the following characteristics:

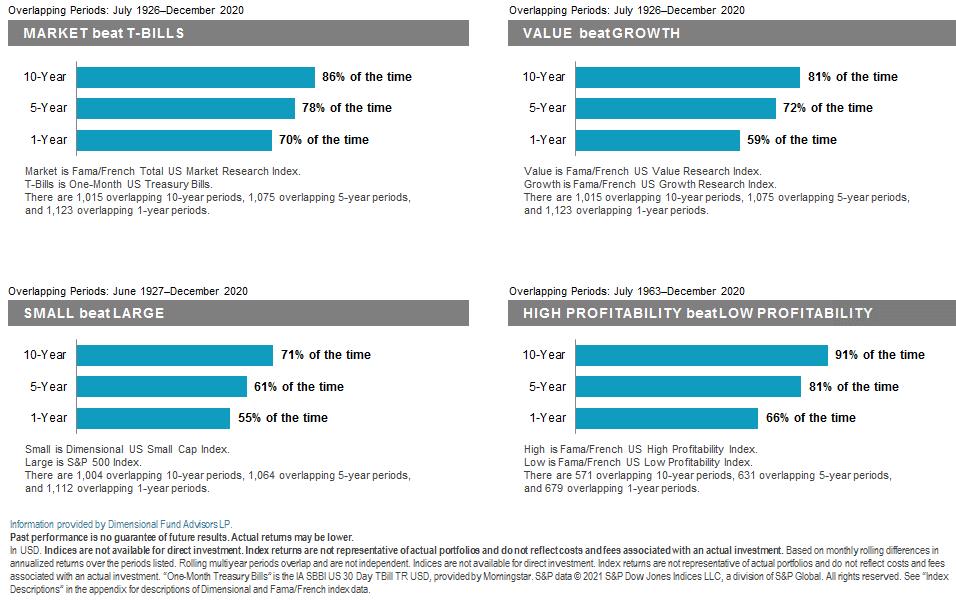

* Equity: Stocks outperform bonds over long periods

* Size: Small companies outperform large companies over long periods

* Price: Value companies outperform growth companies over long periods

* Profitability: High profitability outperforms low profitability over long periods

The graphic of how these factors play out over various rolling periods is below.

It is clear that over ten years the factors soundly prevail, but in shorter-term periods, there is more variability in how the factors perform. So when it comes to playing Wordle feel free to try any strategy that suits you, but when it comes to investing, let’s make sure we are playing for the long-term while focusing on what has been proven to provide us with opportunities to earn excess returns.