Articles

Poll Position

11.04.2022

After last week’s matchup against Kentucky, the lone UK fan at RK has gone from optimistic to talking about basketball season. Depending on the poll that you follow, the No. 1 Tennessee Vols are running hot heading into this weekend’s game against Georgia. Even if it’s not my Purdue Boilermakers, this season has been fun to watch in a year mired in not-so-great events.

In the markets, the Dow Jones finished the month of October with its best month in more than 45 years, jumping 14%. While sports fans keenly watch the weekly matchups and discuss the polling and positions of their favorite teams, investors are focused on a different set of the polls and the potential outcomes for next week’s midterm elections. As usual, the polling data is all over the place, but the consensus seems to point to a Republican-controlled House and Senate. Many investors are left to wonder if a change in the House or Senate’s balance of power could impact their portfolios with the potential for new legislative actions.

So if this happens, what does history show us regarding how markets performed under the two parties?

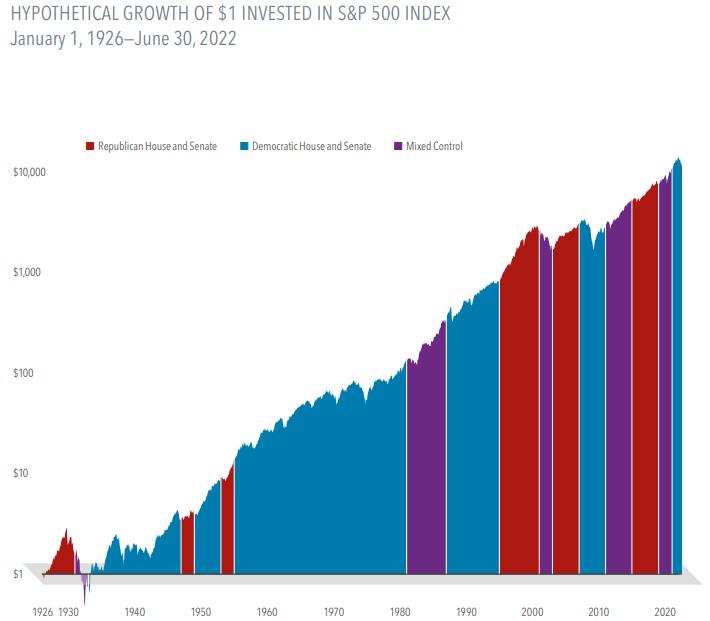

The chart above shows the last hundred years of returns, and generally speaking, the trend is higher for stocks regardless of which party controlled the House or the Senate. Nevertheless, a few salient points can be made about this chart.

From 1926 to 2022, stocks trended higher regardless of whether Democrats or Republicans controlled the House and the Senate or whether control was mixed.

Actions by Congress and other branches of the federal government may impact returns, but other factors like geopolitical events, interest rate changes, and technological advances do too. Decades of research suggest that current market prices incorporate all of this information.

Shareholders invest in companies, not a political party, and companies will continue to focus on serving their customers and growing their businesses and profits, regardless of what happens in Washington.

Some might say this time is different, we have never faced the same circumstances that we are seeing right now, and the risk has never been higher. It easy to forget sometimes, but some companies got their start during similar trying times in the past. My favorite example is Home Depot which went public on September 22, 1981, during the height of the last time inflation rates were high, and the economy was underperforming.

We are undoubtedly facing challenging times, but it doesn’t change the fact that we are investing in companies trying to navigate this environment. So no matter which party holds the balance of power or which SEC team wins it all this year, we can be confident that we are investing in real companies that will continue to attempt to maximize their value for shareholders.