Articles

Coin Appraisal

01.12.2024

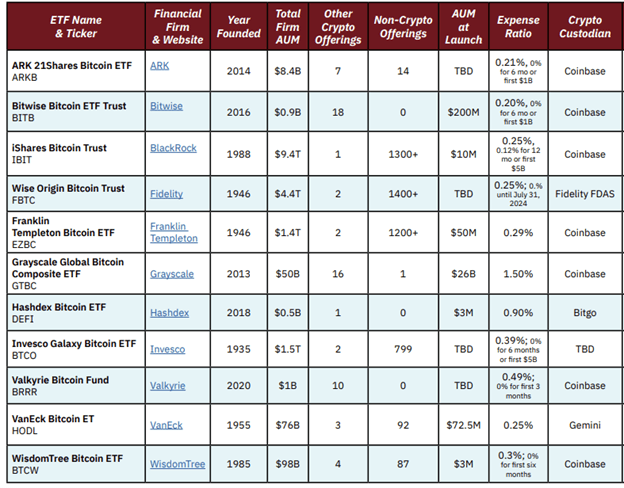

This week, the SEC made a splash in the markets by approving 11 exchange-traded funds (ETFs) designed to follow and track the price of Bitcoin. Firms such as Fidelity, BlackRock, Invesco, and Franklin Templeton have joined in welcoming the first new major asset class in over 100 years to the investing public. While many still have concerns about the long-term legitimacy of digital assets, this approval from a financial regulatory body has undoubtedly decreased the regulatory risk in owning these assets.

Does this mean investors should all pile into the new ETFs and hold Bitcoin in their long-term portfolios?

That is a great question, and when we appraise any investment for our clients, we want to look at it through the following criteria and ensure that it checks the appropriate boxes.

Does this investment have positive expected returns?

Since its inception, Bitcoin has grown in value, given the starting price was below a penny. But with only a track record of 12 years, there needs to be more data to make a statistically significant determination on whether or not the asset has positive expected returns in the future. Stocks and bonds, for example, have nearly 100 years of return history that have been analyzed meaningfully.

Does the investment add diversification to the portfolio?

Running a simple correlation calculation to determine how the price of bitcoin interacts and moves in tandem with stocks and bonds is easy enough. Still, like the expected returns calculation, there needs to be more historical data to determine whether or not this asset will remain non-correlated to stocks and bonds in the future. Additionally, the volatility of Bitcoin is more like that of a commodity, and in its brief history has had many periods where the price has been down more than 75%.

Can this investment be owned in a low-cost way?

The new ETF structure and funds are priced between 25 and 150 basis points per year in management fees, which checks the box for low cost.

Does the investment help accomplish long-term financial goals?

This question is the most appropriate and should be the first one to ask.

The answer is that it depends on your situation and the goals that you are trying to accomplish. Your portfolio is designed to achieve financial goals based on your unique circumstances while (usually) looking at taking the least amount of risk possible to do so. Adding an asset class with such a limited history in terms of return and expected volatility will likely affect that ability.

Over the next couple of decades, the future for digital assets could turn into a boom for investors or a bust, and anyone telling you that they know anything for sure is kidding themselves.

The answer at this point is to treat the digital assets as a speculative vehicle only, and investors should only be willing to put into the investment what they are ready to lose.

The percentage of the portfolio dedicated to digital assets should likewise be sized appropriately so that financial goals can still be met if the worst case happens. If the best case happens, investors could look towards an aspirational financial goal.

We are always looking introspectively at how we view markets and the types of portfolios and assets we include to help our clients reach their financial goals.

Given the unique profile of the digital assets space, we will continue to dig into it to analyze the above questions further and gain clarity around the technology portion, like custody, pricing, and security. We will continue this ongoing appraisal to ensure our client’s portfolios are geared towards expected returns, diversification, and low cost.