Articles

Overconfidence Bias in Italy

10.04.2022

Cars sped by, lanes dissolved into chaos, and my thirteen-year-old self sat in the back seat thinking that driving through Rome was a bad idea. My conviction grew as my dad and aunt, who do not speak Italian, began using an Italian map for directions.

My memories of that day include a credit card getting stuck in a parking garage machine, phones dying, throwing coins in the Trevi Fountain, mouth-watering pizza, and the Colosseum lit up against the dark sky. I also remember my adrenaline-filled dad and aunt, who are both type A business owners, claiming they could win the show Amazing Race. I believe they later retracted that statement.

The day trip to Rome was a success, so their surprising level of confidence in their ability to get us to Rome and back was warranted. Something tells me that if there had been an accident, I would have heard more about how Rome is rated the number one European city for traffic accidents and less about how they could win the Amazing Race.

We’re all guilty of being overconfident at one point or another. Overconfidence bias is when we overestimate our skills or abilities. We tend to credit ourselves for our successes while blaming our failures on external factors.

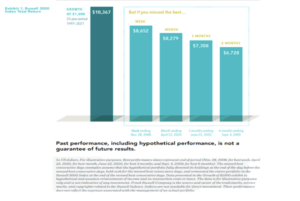

I see this play out in personal finance every day. One example is when investors become overconfident while the market is growing, and then try to time the market to avoid losses once they experience volatility. Instead of preventing losses, they typically end up with below-average investment returns. The chart below shows the profound impact of being out of the market for just a short period. The dark bar represents the hypothetical growth of $1,000 invested in the broad US stock market from 1997-2021. The lighter bars to the right illustrate how your returns would be cut down from simply missing the best week, month, three months, or six months.

Overconfidence bias presents itself in so many other ways in our financial lives: not creating an estate plan because you don’t think anything will happen to you, paying too much in taxes because of what you didn’t know, spending down your assets in retirement because you assumed you’d be fine, and so on. Unfortunately, we are all inclined to fall into this behavior. So, if you recognize yourself in any of these examples, know that you are not alone. When meeting with new clients, we ask, “What is the worst financial decision you have ever made?” I have yet to come across a client who couldn’t come up with an answer. The difference is made when you recognize that your financial life is negatively impacted, and decide to ask for help when needed.

Please reach out if there is an area of your financial life that we can help with.

I recently asked my dad and aunt if they would drive in Rome again if they ever returned. My dad said yes, my aunt said no, but they both mentioned that it was a day they would never forget. Also, pictured below is my younger sister, who may have experienced a bit of her own overconfidence bias in Italy.