Articles

Recency Bias

10.04.2022

Sometimes you know one thing and feel another. My first lesson in this was with cherry tomatoes.

Growing up, Sunday afternoons were spent at my great-grandparents’ home with my cousins. Us kids played outside around their sizable garden, the women sat on the porch and chatted, and the men were usually near a TV watching football.

We always asked if we could pick the fruit and vegetables out of the garden. Again and again we were told no because the corn or cucumbers or watermelon wasn’t ripe yet. But one particular Sunday the answer was, “You could pick the cherry tomatoes.” We were thrilled.

We all gathered handfuls of tomatoes, ran up to the porch to show them off to the adults, and ate as many as we could. We then ran back to the garden to repeat this process. By the third time, I decided to sit in the garden and enjoy eating tomatoes to my heart’s content instead of running back and forth with my cousins. Little did I know, they were leaving their tomatoes in a basket on the porch rather than eating every handful. As you could imagine, my feast in the garden did not mix well with the summer heat.

I intuitively knew that eating that many tomatoes was not a good idea. But I felt like it was because that’s what my cousins were doing! Not only that, but it felt like a once in a lifetime opportunity that had to be taken advantage of after being told “no, not yet” so many times.

Little did I know, not only were my cousins not eating all the tomatoes they picked, but also, that Sunday was the beginning of harvesting season for much of the food in the garden. So, the urgency I felt to eat as many tomatoes as possible was unwarranted.

In personal finance, we frequently feel once thing and know another. We know we should not sell when the market is down. We know that when the market is down it’s a great time to invest extra cash. We know that we shouldn’t make our financial decisions based on what other people are doing. We know we shouldn’t chase returns. We know… but so often our feelings are in conflict with our knowledge.

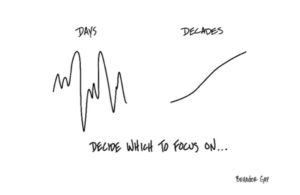

So how do you deal with this conflict? First, be aware of recency bias. In the case of my cherry tomatoes, I was so used to hearing no that I felt like eating food from the garden was a rare opportunity. In reality, the garden had simply been in growing season. A new season was beginning, but I couldn’t see it because I was caught up in the patterns of days and months rather than the patterns of years and decades

Second, work with professionals who will help you gain perspective and act in a way that aligns with what you know and want. For example, consider conflict around your investments. Perhaps you have extra cash but aren’t sure when or how to invest it. Utilizing an Investment Policy Statement is an easy way to decide where every next dollar is allocated and when trades are placed as time goes on. An Investment Policy Statement can help you remain disciplined and unemotional with your investment strategy.

Sometimes dealing with the conflict between what you know and what you feel is as simple as someone you trust saying, “use an investment policy statement” or “stop eating tomatoes”. Other times, it’s more complex. Regardless, the people who can offer perspective are invaluable. We’re here to help. Please reply and let us know if you have any questions or stories of your own.